What Can I Write off As a Doordash Driver

As a DoorDash driver, you can write off gas, maintenance, car insurance, and phone expenses on your taxes. These deductions help maximize your earnings.

If you’re a DoorDash driver, navigating tax deductions can lead to significant savings. Understanding what expenses you can write off can optimize your financial strategy. From gas and car maintenance to insurance and even phone bills, these costs add up and can be claimed as deductions come tax time.

By capitalizing on these write-offs, you not only minimize your tax liability but also enhance your overall profitability as a gig worker. Let’s delve deeper into the various expenses that DoorDash drivers can deduct to ensure you’re making the most of your income while staying tax compliant.

Credit: falconexpenses.com

Vehicle Expenses

As a DoorDash driver, understanding what you can write off as business expenses is crucial. One of the most significant areas of expenditure for self-employed delivery drivers is vehicle-related costs. Here, we will delve into the specifics of vehicle expenses, including fuel and maintenance costs, as well as depreciation and lease expenses.

Fuel And Maintenance Costs

For DoorDash drivers, fuel and maintenance expenses are deductible as long as they are incurred for business purposes. This includes gasoline, oil changes, tire rotations, and other vehicle-related maintenance services. Keeping detailed records of these expenses can help you in claiming them as deductions on your taxes.

Depreciation And Lease Expenses

For those who own their vehicles, depreciation is a deductible expense. This reflects the wear and tear of your vehicle as you use it for business. Alternatively, if you lease a vehicle for business purposes, the lease payments are also deductible. It’s important to keep track of your lease payments and depreciation costs throughout the year so that you can accurately report them for tax purposes.

Business Expenses

Cell Phone And Data Plans

As a DoorDash driver, you can write off cell phone and data plans used for work purposes.

Delivery Supplies

Consider delivery supplies such as insulated bags, food containers, and protective gear.

Accounting And Legal Fees

Don’t forget about possible accounting and legal fees related to managing your business.

Home Office Expenses

When it comes to being a DoorDash driver, you may qualify for certain tax deductions related to your home office expenses. Let’s explore some key categories that you can consider when filing your taxes.

Rent Or Mortgage Interest

If you use a part of your home exclusively as your office, you can deduct a portion of your rent or mortgage interest.

Utilities And Internet Bills

You can deduct a percentage of your utilities and internet bills based on the space your home office occupies.

Credit: falconexpenses.com

Insurance And Licensing Costs

As a Doordash driver, you can write off insurance and licensing costs as part of your business expenses. These include vehicle insurance, license and registration fees, and other expenses related to maintaining the legal requirements for your work. These write-offs can help lower your tax liability and maximize your earnings as an independent contractor.

Liability Insurance Premiums

“` Liability insurance premiums are a crucial expense for Doordash drivers, offering protection in the event of accidents or other unforeseen incidents. These premiums can be deducted as a business expense, providing tax relief for drivers. It’s important for Doordash drivers to maintain adequate liability insurance coverage to safeguard themselves and their vehicles while on the job. “`htmlVehicle Registration And Inspection Fees

“` Another deductible expense for Doordash drivers includes vehicle registration and inspection fees. These costs are directly associated with operating a vehicle for business purposes. By deducting these fees, drivers can effectively lower their taxable income, potentially leading to significant savings at tax time. Regular vehicle inspections are crucial to ensuring the safety and reliability of a vehicle used for Doordash deliveries. In summary, insurance and licensing costs are substantial for Doordash drivers, influencing both their safety and tax obligations. Being aware of the deductible nature of certain expenses can help drivers optimize their financial situation while maintaining compliance with legal and safety requirements.Meal And Entertainment Expenses

When it comes to being a DoorDash driver, it’s important to understand what expenses you can write off. One category that can potentially save you money is meal and entertainment expenses. As a delivery driver, you’re constantly on the go, and it’s only natural that you’ll need to eat while on the job. Additionally, you may find yourself wanting to show appreciation to your customers through small gestures. Let’s take a closer look at what you can write off under these two subcategories:

Meals While On Delivery

As a DoorDash driver, you’re often driving from one restaurant to another, picking up and delivering orders. During these trips, you may need to grab a quick meal to keep your energy up. The good news is that you can deduct the cost of these meals as a business expense. However, there are a few important things to keep in mind:

- Make sure you keep all your receipts for meals while on delivery. This will serve as proof in case you get audited.

- Remember that you can only deduct 50% of your meal expenses. So, be mindful of this when calculating your deductions.

- It’s important to note that meals you eat at home or during your regular breaks are not eligible for deductions.

| Expenses | % Deductible |

|---|---|

| Meals while on delivery | 50% |

| Meals at home or regular breaks | No deduction |

Customer Appreciation Gestures

Providing excellent service to your customers is not only important for your ratings but can also lead to higher tips. As a way to go above and beyond, you may want to show your appreciation through small gestures. These can include providing complementary items such as drinks, condiments, or even a small snack. The good news is that you can deduct the cost of these gestures as a business expense to help offset your overall expenses. Just remember to keep track of the amounts spent and the dates so that you can properly document these deductions.

Overall, as a DoorDash driver, it’s important to take advantage of all the deductions you’re eligible for. By understanding what you can write off under the meal and entertainment category, you’ll be able to maximize your tax savings and ultimately increase your bottom line.

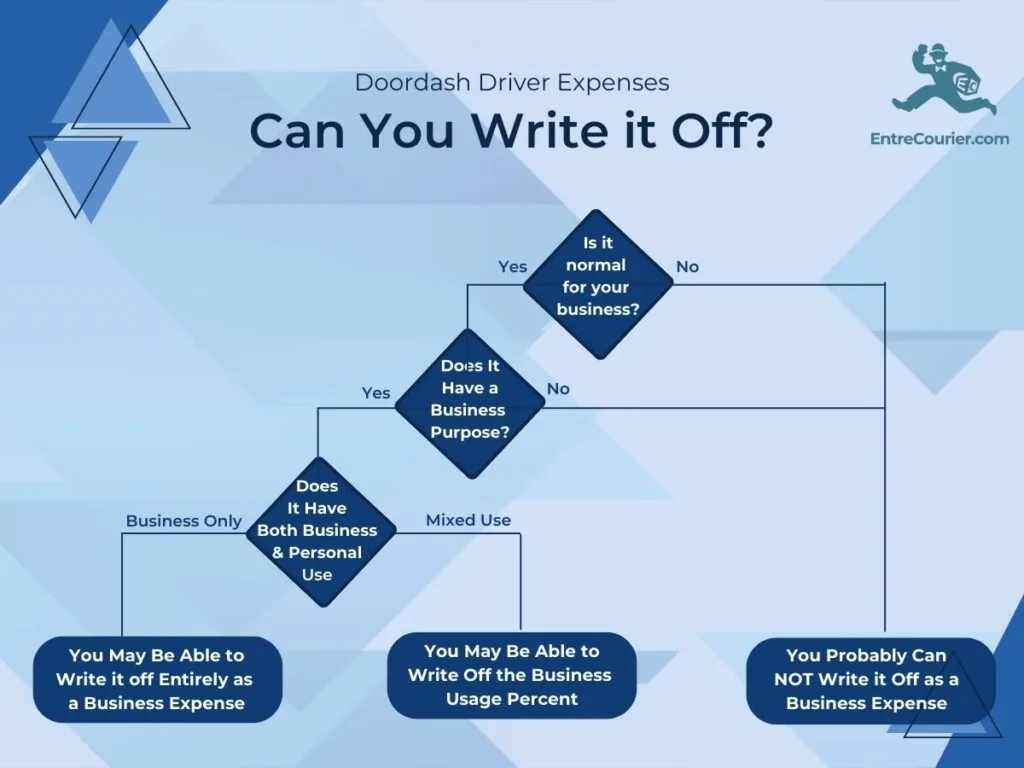

Credit: entrecourier.com

Other Deductible Expenses

As a DoorDash driver, you have the opportunity to deduct several other expenses on your taxes. These deductions can help reduce your taxable income and save you money, so it’s essential to take advantage of them. In this section, we’ll discuss two additional deductible expenses: health insurance premiums and self-employment taxes.

Health Insurance Premiums

If you’re a DoorDash driver and you pay for your health insurance, you may be able to deduct your premiums as a business expense. This deduction can help offset the cost of healthcare and reduce your tax liability.

Important: To qualify for this deduction, you must meet certain criteria:

- Your health insurance plan must be established under your own or your spouse’s business.

- You cannot be eligible for any other health insurance coverage, including coverage through a spouse’s employer.

- Your premiums must be paid with after-tax dollars.

Deducting your health insurance premiums can be a significant advantage for DoorDash drivers who don’t have access to employer-sponsored coverage. It’s always a good idea to consult with a tax professional for advice specific to your situation.

Self-employment Taxes

As a DoorDash driver, you’re considered self-employed, which means you’re responsible for paying self-employment taxes. However, the good news is that you can deduct part of these taxes on your tax return.

Tip: Self-employment taxes consist of both the employer and employee portions of Social Security and Medicare taxes, which can add up to a sizeable amount.

To calculate your deductible self-employment taxes, you’ll need to complete IRS Schedule SE. This form allows you to deduct the employer portion of self-employment taxes on your personal tax return.

Important: Keep in mind that deducting self-employment taxes can be a bit complex, so it’s recommended that you seek professional guidance to ensure accuracy and maximize your deductions.

In conclusion, as a DoorDash driver, you have the opportunity to deduct health insurance premiums and a portion of your self-employment taxes. These deductions can significantly lower your taxable income and help you save money on your taxes. Remember to consult with a tax professional to ensure you’re taking full advantage of these deductible expenses.

Frequently Asked Questions For What Can I Write Off As A Doordash Driver

What Expenses Can I Write Off As A Doordash Driver?

As a Doordash driver, you can write off expenses such as vehicle maintenance, fuel costs, phone and internet bills, parking fees, and even the cost of insulated delivery bags.

Are My Car Insurance Premiums Tax-deductible As A Doordash Driver?

No, car insurance premiums are not tax-deductible for Doordash drivers. However, any expenses related to your vehicle that are directly tied to your Doordash business can be deducted.

Can I Deduct The Cost Of My Doordash Delivery Bags?

Yes, you can deduct the cost of purchasing or renting insulated delivery bags as a Doordash driver. These bags are essential to keeping customers’ food warm during delivery, making them a legitimate business expense.

Can I Deduct The Cost Of My Doordash Uniform?

Yes, you can deduct the cost of your Doordash uniform as a business expense. This includes any branded clothing or accessories you use exclusively for work, such as hats, shirts, or bags.

Conclusion

As a DoorDash driver, you can write off various expenses such as mileage, maintenance, and supplies. It’s essential to keep detailed records and stay informed about tax regulations in order to maximize your deductions. By understanding the eligible write-offs, you can effectively reduce your tax liability and increase your overall earnings.